What does the Infrastructure Investment and Jobs Act mean for OSMRE's AML Program?

The Infrastructure Investment and Jobs Act

Public Law 117-58: The Infrastructure Investment and Jobs Act was enacted on November 15, 2021. This enacted legislation included language that directly, or in some cases indirectly, impacts OSMRE. In addition to the extension of abandoned mine land (AML) fee collections and mandatory AML Grant distributions, $11.293 billion in new funding was authorized to be appropriated for deposit into the Abandoned Mine Reclamation Fund.

Final Guidance for Implementation of the STREAM Act’s Long Term AML Reclamation Fund Available

The Consolidated Appropriations Act, 2023, included an amendment to section 40701 of the Infrastructure Investment and Jobs Act that authorized eligible States and Tribes to deposit up to 30 percent of their annual IIJA abandoned mine land grant amount in a long-term AML reclamation fund established under State or Tribal law. This amendment is commonly referred to as the STREAM Act.

How to Apply for AML Grants under the Act

Final Guidance for the IIJA Abandoned Mine Land Grant Program.

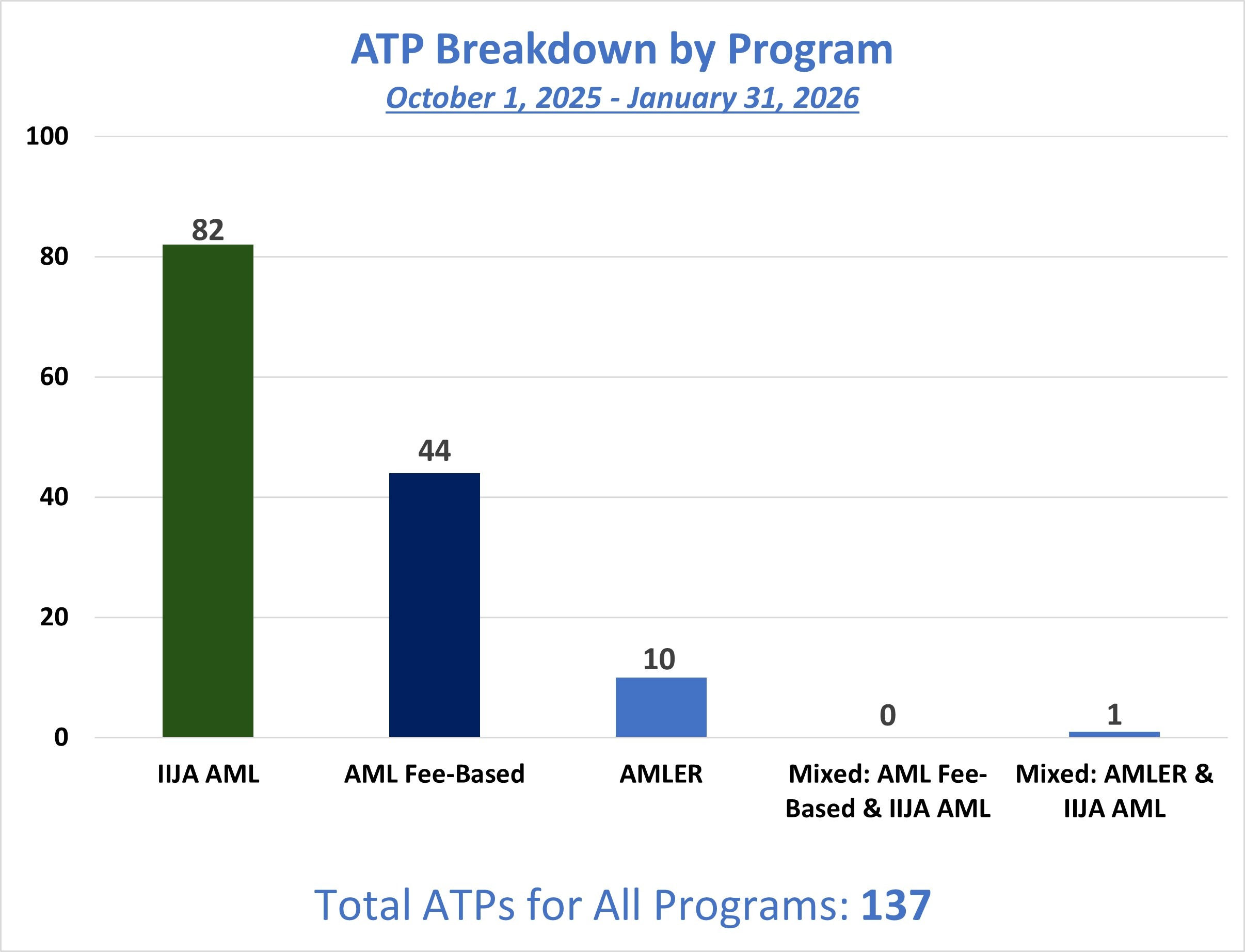

Status of Authorizations To Proceed by Fiscal Year

- As of January 31st in Fiscal Year 2026, a total of 137 ATPs have been approved across all AML Reclamation programs.

- As of September 30th in Fiscal Year 2025, a total of 479 ATPs have been approved across all AML Reclamation programs.

- As of September 30th in Fiscal Year 2024, a total of 424 ATPs have been approved across all AML Reclamation programs.

- As of September 30th in Fiscal Year 2023, a total of 374 ATPs have been approved across all AML Reclamation programs.

Learn more about Authorizations To Proceed

This bar graphs displays the number of Authorizations To Proceed (ATPs) approved by programs for FY26. The X axis displays the three programs, IIJA-AML, AML Fee-Based and AMLER, along with two mixed programs, AML Fee-Based & IIJA-AML and AMLER & IIJA-AML. The Y axis displays the number of approved ATPs: 82 IIJA-AML, 44 AML Fee-based, 10 AMLER, 0 AML Fee-Based & IIJA-AML, and 1 AMLER & IIJA-AML for a total of 137.

Provisions under the Act that impact the AML Program

With the passage of the Act, OSMRE takes on a new opportunity to invest in our infrastructure and benefit the American public for the next generation.

This key investment will improve federal stewardship of our critical infrastructure and significantly increase OSMRE efforts to support our partners, stakeholders, Tribal nations, and communities. Most notably, this federal law expands investment in the Abandoned Mine Land (AML) program. Implementing this law and delivering meaningful results is a top priority for OSMRE.

In addition to the changes to the existing AML Program, the law authorizes $11.293 billion to be deposited into the Abandoned Mine Land Fund to be distributed as follows:

- Infrastructure Law AML Reclamation Grants to Eligible states and Tribes

- OSMRE will distribute amounts made available in the appropriation to eligible states and Tribes on an equal annual basis over a 15-year period in accordance with the provisions of the infrastructure law.

- Up to 3% for OSMRE Operations

- Up to 3 percent of the amount appropriated in the law may be used for OSMRE's administration of the program.

- 0.5% for Office of Inspector General Operations

- One-half of one percent of amounts made available in the law must be transferred to the Office of the Inspector General of the Department of the Interior for oversight of funding

- $25 million for Financial and Technical Assistance

- States and Tribes will be provided with the financial and technical assistance necessary for the purpose of making amendments to the Abandoned Mine Land Inventory System (e-AMLIS).

The distribution announced on February 7, 2022, is the first of 15 annual installments under the IIJA that will provide approximately $10.87 billion (after IIJA directed reductions) for AML reclamation projects, in addition to funds available under AML-fee based grants.

As directed by the IIJA, the distribution amounts were based on the number of tons of coal historically produced in each State or from the applicable Indian lands before August 3, 1977. OSMRE relied on the March 1980 Final Environmental Impact Statement (OSM-EIS-2) to ascertain these amounts and then calculated each State’s or Tribe’s percentage of total historic coal production.

Frequently Asked Questions

Following passage of the Act, the Office of Surface Mining and Reclamation Enforcement received several questions as to whether the Act’s provisions for reclamation encompass funding for certain acid mine drainage (AMD) projects.

Below, OSMRE provides guidance on some of these questions.

-

States and tribes have been getting AML money every year for decades – is this just the same?

No – the annual AML fee-based grants that States and Tribes receive are separate from the Infrastructure Investment and Jobs Act (IIJA) AML grants. AML fee-based grants are funded primarily by reclamation fees and distributed as required by section 402 of the Surface Mining Control and Reclamation Act of 1977 (SMCRA), while IIJA AML grants are funded with moneys from the United States Treasury and distributed as required by section 40701 of the IIJA.

The distribution announced on February 7, 2022, was the first of 15 annual installments under the IIJA that will provide approximately $10.87 billion (after IIJA-directed reductions) for AML reclamation projects, in addition to funds available under AML fee-based grants. The IIJA AML guidance documents published in July 2022, June 2023, and June 2024 provide additional details on the IIJA AML grants and expectations for the program for fiscal years (FY) 2022-2024. OSMRE is issuing a FY 2025 IIJA AML guidance with the FY 2025 IIJA AML distribution.

-

How will the IIJA AML distribution amounts be calculated in FY 2025?

As directed by the IIJA, the distribution amounts are based on the number of tons of coal historically produced in each State or from the applicable Indian lands before August 3, 1977. OSMRE relied on the March 1980 Final Environmental Impact Statement (OSM-EIS-2) to ascertain these amounts and then calculated each State’s or Tribe’s percentage of total historic coal production. Once calculated, that percentage was simply multiplied by $10.87 billion and divided by 15. As eligible States and Tribes update their inventories, OSMRE will adjust distributions to ensure that each eligible State and Tribe receives at least $20 million over the course of the 15-year distribution, unless the amount needed for reclamation on State and Tribal lands is less than $20 million, creating specific exceptions in Alaska and Texas.

-

Why are there exceptions?

The IIJA provides that the total amount of IIJA grant funding that each eligible State or Tribe receives over the life of the program will not be less than $20 million unless the State or Tribe has less than $20 million in unfunded AML reclamation costs.

In FY 2022, Alaska had an unfunded inventory of roughly $25.8 million, so its 15-year allocation was increased from $3.3 million (under the formula) to $20 million. Providing additional funds to Alaska required recalculating the distributions to the other States and Tribes, which was carried out in proportion to their historic coal percentage. The same calculation methodology was applied to Alaska in FYs 2023, 2024, and 2025, resulting in a grant distribution amount of approximately $1.3 million.

In FY 2024, Texas had an unfunded inventory of roughly $40.3 million, so its 15-year allocation was increased from $14.8 million (under the formula) to $20 million. Providing additional funds to Texas required recalculating the distributions to the other States and Tribes, which was carried out in proportion to their historic coal percentage. The same calculation methodology was applied to Texas in FYs 2023, 2024, and 2025, resulting in a grant distribution amount of approximately $1.3 million.

-

Was the same calculation methodology used to calculate IIJA AML distribution amounts in previous years?

Yes.

-

When will States and Tribes receive FY 2025 IIJA funds?

OSMRE will publish revisions to the final IIJA Guidance by June 2025, with pertinent information explaining how eligible States and Tribes may apply for FY 2025 IIJA funds. We expect eligible States and Tribes will start applying for these funds in June 2025.

-

Will States and Tribes be able to apply for these IIJA funds each year?

Yes. Eligible States and Tribes will be able to apply annually for the amount specified in each fiscal year’s IIJA grant distribution.

-

Will States and Tribes be required to submit separate grant applications for IIJA AML grants and the AML fee-based grants?

Yes. OSMRE is requiring a separate grant application for IIJA AML funding to ensure—consistent with federal financial assistance requirements—its ability to track the expenditure of IIJA funds, ensure proper oversight of taxpayer dollars, facilitate audit reviews, be responsive to reporting requirements, and enhance transparency about the use of funds. OSMRE will continue to work with the States and Tribes to develop procedures that minimize burdens on applicants resulting from separate IIJA and fee-based AML applications.

-

Is the $8 million in IIJA funding for e-AMLIS related activities to States and Tribes a one-time distribution?

Yes.

-

For AML projects where OSMRE has completed its NEPA review and issued an Authorization to Proceed (ATP) to States or Tribes, will OSMRE require the States or Tribes to resubmit that paperwork for an additional ATP approval using IIJA funds, or allow those projects to proceed under prior approvals?

Assuming there has been no change in the scope of work and all legal requirements (e.g., compliance with the Davis-Bacon and Build America, Buy America Acts) have been or will be met, if OSMRE’s NEPA review is complete and an ATP has already been issued, States and Tribes will not need to resubmit projects for additional approval to use IIJA funding.

-

How is “current and former employee of the coal industry” defined? Will former and current employees of coal-fired power plants be considered “former and current employees of the coal industry” for purposes of IIJA implementation?

Yes. OSMRE defines a “current or former employee of the coal industry” as:

(a) Any individual who is currently employed by:

- ) A surface coal mining operation, as defined by 30 U.S.C. § 1291;

- ) A facility directly related to a surface coal mining operation, such as a coal preparation plant;

- ) A coal end-use facility, such as a coal-fired power plant; or

- ) An entity that transports coal or related materials from a surface coal mining operation, preparation plant, or end-use facility.

(b) Any other individual who earned the majority of their annual income from one or more of the employers in paragraph (a).

(c) This term does not include an individual who is or has been—

- ) A sole proprietor or owner of record in excess of 50 percent of the voting securities or other instruments of ownership of an entity listed in paragraph (a); or

- ) An officer or director of such entity.

-

What information must be included in FY 2025 grant applications?

To receive FY 2025 IIJA funds, grant applications must include a budget justification breakdown explaining how funds will be allocated in the IIJA AML subaccounts (see Appendix I: Subaccounts for IIJA AML Financial Assistance) and a Program Narrative summarizing how project selection practices will achieve reclamation and socio-economic benefits.

To receive FY 2025 IIJA AML funds, a State’s or Tribe’s completed grant application must include the OMB-approved forms identified in the IIJA AML Grant Notice of Funding Opportunity in order to process required assistance agreement (i.e., signed application for Federal Assistance SF-424 and related forms, budget justification forms, program narrative forms, etc.).

In addition, Appendix II of the IIJA AML Guidance must be submitted as part of the FY 2025 grant application. As indicated in the IIJA AML Guidance, Appendix II will be comprised of a list of Problem Area Descriptions (PADs) with AML problems that are proposed to be funded during the next five years from the time the list is submitted.

-

Will States and Tribes be allowed to consolidate the administrative costs they charge to AML grants to one form of grant, e.g., put all administrative costs for both their AML fee-funded and IIJA grant-funded AML work on their IIJA grant?

No. As required under the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, at 2 CFR Part 200, Subpart D, grant funds must be expended and accounted for in accordance with applicable statutory authorities and through adequate fiscal control procedures so that the expenditure of these funds can be monitored and tracked to ensure compliance with the assistance agreement. It is imperative to maintain an effective system of controls and accountability for the use of these funds that ensure alignment with the activities supported by the grant agreement.

-

How will the period of performance for the IIJA grants be determined? How much flexibility will States and Tribes have to receive funds at different times to better align with their unique financial situations?

The period of performance for each IIJA AML grant is five years from the award issue date. OSMRE will, however, work with each State and Tribe to address its unique situation where appropriate.

-

Will States and Tribes be allowed to receive IIJA funding if they have not completed updates to their AML Reclamation Plans?

Yes. States and Tribes are not required to complete the AML Reclamation Plan update, review, and approval process as a prerequisite to receiving IIJA funds.

-

Pursuant to section 40701 of the IIJA, may eligible States and Tribes use grant funds to design and build AMD treatment facilities? If so, may grant funds be used to design and build AMD treatment facilities that are “stand alone” Priority 3 projects (i.e., not in conjunction with a Priority 1 or Priority 2 site or within a qualified hydrologic unit)?

Yes. Eligible States and Tribes may use IIJA AML grant funds to design and build AMD treatment facilities and may use those funds to design and build AMD treatment facilities that are not in conjunction with a Priority 1 or Priority 2 site or within a qualified hydrologic unit. Section 40701(c) of the IIJA authorizes grant recipients to use IIJA funds for the “activities described in subsections (a) and (b) of section 403 and section 410 of [SMCRA],” and to deposit up to 30% of their annual IIJA grant amount in a long-term abandoned mine land reclamation fund if those amounts are used for, among other things, “the abatement of the causes and the treatment of the effects of acid mine drainage resulting from coal mining practices, including for the costs of building, operating, maintaining, and rehabilitating acid mine drainage treatment systems.” Nothing in the IIJA explicitly or implicitly incorporates other law that might limit expenditures for AMD treatment facilities to those that are in conjunction with a Priority 1 or Priority 2 site or within a qualified hydrologic unit, e.g., section 402(g) of SMCRA.

-

Pursuant to section 40701 of the IIJA, may eligible States and Tribes use grant funds to operate, maintain, and rehabilitate AMD treatment facilities?

Yes. Eligible States and Tribes may use IIJA AML grant funds to operate, maintain, and rehabilitate AMD treatment facilities as part of the activities described in section 40701(c) of the IIJA. These uses are contemplated by the IIJA, and nothing in the relevant portions of the IIJA or SMCRA forecloses these uses.

The Consolidated Appropriations Act, 2023 (commonly referred to as the STREAM Act), amended section 40701 of the IIJA to authorize eligible States and Tribes to deposit up to 30 percent of their annual IIJA AML grant amount in a long-term AML reclamation fund established under State or Tribal law. 30 U.S.C. § 1231a(c)(2).

-

Pursuant to the STREAM Act, may eligible States and Tribes place a portion of their IIJA grant funds into their fee-based acid mine drainage (AMD) set aside accounts?

Yes, a State or Tribe may choose to deposit up to 30 percent of their IIJA AML grant in an already existing fee-based AMD set-aside account if consistent with State or Tribal law and the applicable reclamation plan. Given the different funding source and purposes for which the STREAM Act funds can be used, however, States and Tribes may choose to establish a long-term AML reclamation fund that is separate from any existing fee-based AMD set-aside account.

Regardless of whether a State or Tribe sets up a separate long-term AML reclamation fund or uses an existing fee-based AMD set-aside account, the State or Tribe must ensure that it has adequate fiscal, accounting, and internal control measures in place to separately monitor and track STREAM Act and fee-based AMD set-aside funds.

States and Tribes must demonstrate in their STREAM Act fund request that their financial management system is capable of tracing STREAM Act funds “to a level of expenditures adequate to establish that such funds have been used according to the Federal statutes, regulations, and the terms and conditions of the Federal award.” 2 C.F.R. § 200.302(a). At a minimum, this will include ensuring that STREAM Act funds and interest attributed to those funds can be accounted for, tracked, and used only for one of the three purposes set forth in 30 U.S.C. § 1231a(c)(2)(A)(i)-(iii).

-

If IIJA grant funds are deposited into a long-term reclamation fund separate from an already existing fee-based AMD set-aside account, is the long-term reclamation fund required to receive interest in the same way that the fee-based AMD set-aside account does?

Yes. Long-term AML reclamation funds established pursuant to the STREAM Act and fee-based AMD set-aside accounts established pursuant to section 402(g)(6) of SMCRA are both required to be deposited in those accounts “together with all interest earned on the amounts.” 30 U.S.C. § 1231a(c)(2)(A) and § 1232(g)(6)(A).

-

Will AML projects funded by a State’s or Tribe’s long-term AML reclamation fund be subject to National Environmental Policy Act (NEPA) and Authorization to Proceed (ATP) requirements?

An AML project that is exclusively funded by STREAM Act funds—like projects exclusively funded by fee-based AMD set-aside funds—is not subject to NEPA or ATP requirements but must be entered into e-AMLIS and included in the annual grant reports and Annual Evaluation report.

However, an AML project that is funded by combining STREAM Act funds with another funding source, such as IIJA AML, AML fee-based, or FY 2016-2023 Abandoned Mine Land Economic Revitalization (AMLER) funds is subject to NEPA and ATP requirements. These projects must also be entered into e-AMLIS and included in the annual grant reports and Annual Evaluation Report.

-

Will AML projects funded by a State’s or Tribe’s long-term AML reclamation fund be subject to the Build America, Buy America Act (BABA) and the Davis-Bacon Act?

Yes, the IIJA requires all projects that will be assisted in whole or in part by funding made available under the IIJA to comply with the Davis-Bacon Act. In addition, the BABA Act established a domestic content procurement preference for infrastructure projects funded by Federal financial assistance obligated after May 14, 2022. Please refer to the latest version of the Guidance on the Infrastructure Investment and Jobs Act Abandoned Mine Land Grant Implementation for additional information on BABA and the Davis-Bacon Act.

-

Are States and Tribes required to report on the status of their IIJA long-term AML reclamation fund once established?

Yes, the STREAM Act requires annual reporting on the status and balance of long-term AML reclamation funds for the life of the fund. Refer to 30 U.S.C. § 1231a(c)(2)(B) and the STREAM Act guidance for more information on reporting requirements.

-

The STREAM Act was enacted in December 2022. Can eligible States and Tribes submit a grant amendment for their FY 2022-2024 grant funds to place up to 30% into a long-term AML reclamation fund to earn interest?

Yes, eligible States and Tribes may submit a grant amendment request, which, if approved, would allow them to deposit up to 30 percent of their FY 2022-2024 IIJA grant into a long-term AML reclamation fund. However, to make such a deposit, eligible States and Tribes must have sufficient statutory authority and a long-term AML reclamation fund that is consistent with the State’s or Tribe’s existing OSMRE-approved AML reclamation plan. In addition to their grant amendment request, States and Tribes should submit a letter/legal opinion from the State’s or Tribe’s Attorney General or the reclamation agency’s chief legal officer that demonstrates that the State or Tribe has the necessary statutory authority under State or Tribal law to deposit the funds into a long-term AML reclamation fund and to expend the funds in compliance with the STREAM Act, the IIJA, SMCRA, and their approved AML reclamation plan. Refer to the STREAM Act guidance for additional information on STREAM Act fund requests.

Additional FAQs -

If I deposit my STREAM Act funds into my existing fee-based AMD set-aside account authorized under section 402(g)(6) of SMCRA (as previously approved by OSMRE in my AML program), how may these funds be used?

This is a fact specific inquiry that will depend on the State’s or Tribe’s existing statutory authority. If the State’s or Tribe’s Attorney General or the reclamation agency’s chief legal officer reasonably determines that existing law provides sufficient authority to place these funds in an existing AMD set-aside account for the expanded uses contemplated under the STREAM Act, then the State or Tribe may use all of the STREAM Act funds (and interest earned on STREAM Act funds) for all the authorized uses (i.e., coal mine subsidence, coal mine fires, and AMD abatement for both qualified and non-qualified hydrologic units). Funds in the existing AMD set-aside account from fee-based collections (and interest earned on those funds) can only be used for AMD abatement in qualified hydrologic units as specified in 30 U.S.C. § 1232(g)(6).

However, if OSMRE, as informed by information provided by the State or Tribal legal officer, concludes that a State’s or Tribe’s existing statutory authority restricts the use of all funds placed in the existing set-aside to only AMD abatement in qualified hydrologic units, then STREAM Act funds placed in an existing AMD set-aside account could only be used for AMD abatement in qualified hydrologic units as specified in 30 U.S.C. § 1232(g)(6). Under this scenario, the State or Tribe would have the option to obtain the requisite State or Tribal statutory authority and/or amend its AML Reclamation Plan to facilitate the broader uses of the STREAM Act funds as prescribed in 30 U.S.C. § 1231a(c)(2).

-

Do I have to request the entire 30% in each annual IIJA grant application?

No. States and Tribes have the flexibility to determine what percentage of each annual grant amount will meet their needs, up to 30% of their annual IIJA grant funding.

-

Why does my grant award include terms and conditions regarding STREAM Act funds?

These terms and conditions describe the legal requirement that adequate financial management systems and accounting controls must be in place to monitor and track STREAM Act funds.

-

Are States and Tribes required to update their AML Reclamation Plans before they can begin depositing IIJA grant funds into a long-term AML reclamation fund?

It depends. It is possible that a State or Tribe currently has sufficient authority pursuant to State or Tribal law(s) and its already-approved reclamation plan to allow that State or Tribe to deposit and expend funds for the expanded purposes set forth in the STREAM Act without further amendment. A State or Tribe that wants to put money in a long-term AML set-aside account should submit with its grant application or grant amendment request a letter/legal opinion from the State’s or Tribe’s Attorney General or the reclamation agency’s chief legal officer that demonstrates that the State or Tribe has the necessary statutory authority under State or Tribal law, whether existing or newly enacted, to deposit the funds into a long-term AML reclamation fund and to expend the funds in compliance with the STREAM Act, the IIJA, SMCRA, and their approved AML reclamation plan. Refer to the STREAM Act guidance for additional information on STREAM Act fund requests.

-

What is the process for submitting the letter/legal opinion from the State’s or Tribe’s Attorney General or the reclamation agency’s chief legal officer?

The letter/legal opinion from the State’s or Tribe’s Attorney General or the reclamation agency’s chief legal officer may be uploaded into GrantSolutions along with the grant application or grant amendment request. In addition, if this is the first time developing such documentation, we encourage you to provide a copy of this letter/legal opinion to your regional OSMRE office.

-

What information should be included in the letter/legal opinion from the State’s or Tribe’s Attorney General or the reclamation agency’s chief legal officer?

States and Tribes should submit with their grant application or grant amendment request a letter/legal opinion from the State’s or Tribe’s Attorney General or the reclamation agency’s chief legal officer that demonstrates that the State or Tribe has the necessary statutory authority under State or Tribal law to deposit the funds into a long-term AML reclamation fund and to expend the funds in compliance with the STREAM Act, the IIJA, SMCRA, and their approved AML reclamation plan.

States and Tribes should include the following in the letter/legal opinion from the State’s or Tribe’s Attorney General or the reclamation agency’s chief legal officer:

- An analysis with specific citations to State or Tribal statutes, regulations, and an approved reclamation plan, as applicable, that demonstrate the ability to establish a long-term AML reclamation fund or to deposit IIJA AML grant funds in an existing fee-based AMD set-aside account. If an existing fee-based AMD set-aside account will be used, the letter should demonstrate, pursuant to 2 C.F.R. § 200.302(a), how STREAM Act funds will be monitored, tracked, and generally accounted for separate from fee-based monies; and

- An analysis with specific citations to State or Tribal statutes, regulations, and an approved reclamation plan, as applicable, that demonstrates the ability to expend grant moneys to address AMD, subsidence, and mine fires with IIJA AML grant funds set-aside pursuant to the STREAM Act. If an existing fee-based AMD set-aside account will be used, the letter should demonstrate how STREAM Act funds will be monitored, traced, and generally accounted to ensure that fee-based moneys are only spent on AMD projects within qualified hydrologic units.

-

Are States and Tribes required to report on the status of long-term AML reclamation funds beyond the IIJA grant period of performance?

Yes. States and Tribes must annually document and report the status and balance of the long-term AML reclamation fund amounts for the life of the long-term AML reclamation fund. 30 U.S.C. § 1231a(c)(2)(B).

Although the period of performance for a IIJA AML grant is five years, with an option for a one-time no-cost extension of up to one year, subject to OSMRE’s review and approval, eligible States and Tribes must report annually on the status of each long-term AML reclamation fund (projects funded, fund expenditures and the balance of available funds) until the funds are totally expended.

All AML projects, including those that are exclusively funded using IIJA long-term AML reclamation funds, must be entered into e-AMLIS and included in Annual Evaluation Reports and annual grant reports. For specifics related to e-AMLIS data entry, see OSMRE’s Directive AML-1. For information related to annual reporting, see OSMRE’s Directive AML-22.

-

Will a fund type designation for funds set aside under the STREAM Act be added in e-AMLIS to separate it from existing funds designations of SGA, IIJA, MLR, and AMA?

Yes. In June 2024, e-AMLIS incorporated a new funding designation that allowed for the tracking of AML problems reclaimed using the STREAM Act funding source.

-

Can OSMRE use data in e-AMLIS to track projects funded through STREAM Act set aside accounts?

Yes. As the new code was established in June 2024, OSMRE can use data from e-AMLIS to track projects funded with STREAM Act moneys. While e-AMLIS houses data for completed costs associated with reclaimed AML problems, other related project costs, such as procurement actions and project engineering and design costs, are not captured in e-AMLIS. These project costs are tracked through the annual grant report required by 30 U.S.C. § 1231a(c)(2)(B)(ii).

-

Does the STREAM Act place a time limit on the expenditure of IIJA AML funds deposited into a long-term AML reclamation fund?

No. The STREAM Act does not place any time limits on the expenditure of funds deposited into a long-term AML reclamation fund. 30 U.S.C. § 1231a(c)(2)(C)(i) -(ii) specifically provide that amounts retained pursuant to the STREAM Act are not subject to the clawback under 30 U.S.C. § 1231a(4)(B) or any other limitation that may be placed on annual IIJA AML grant funds.

-

Where can I find additional information about the STREAM Act?

For additional information about the STREAM Act, see the Final Guidance for Implementation of the STREAM Act’s Long Term AML Reclamation Fund.